Content

Therefore, we need to transfer the balances in revenue, expenses and dividends into Retained Earnings to update the balance. Once this closing entry is made, the revenue account balance will be zero and the account will be ready to accumulate revenue at the beginning of the next accounting period. Third, the income summary account is closed and credited to retained earnings. Temporary accounts are used to record accounting activity during a specific period. All revenue and expense accounts must end with a zero balance because they are reported in defined periods and are not carried over into the future.

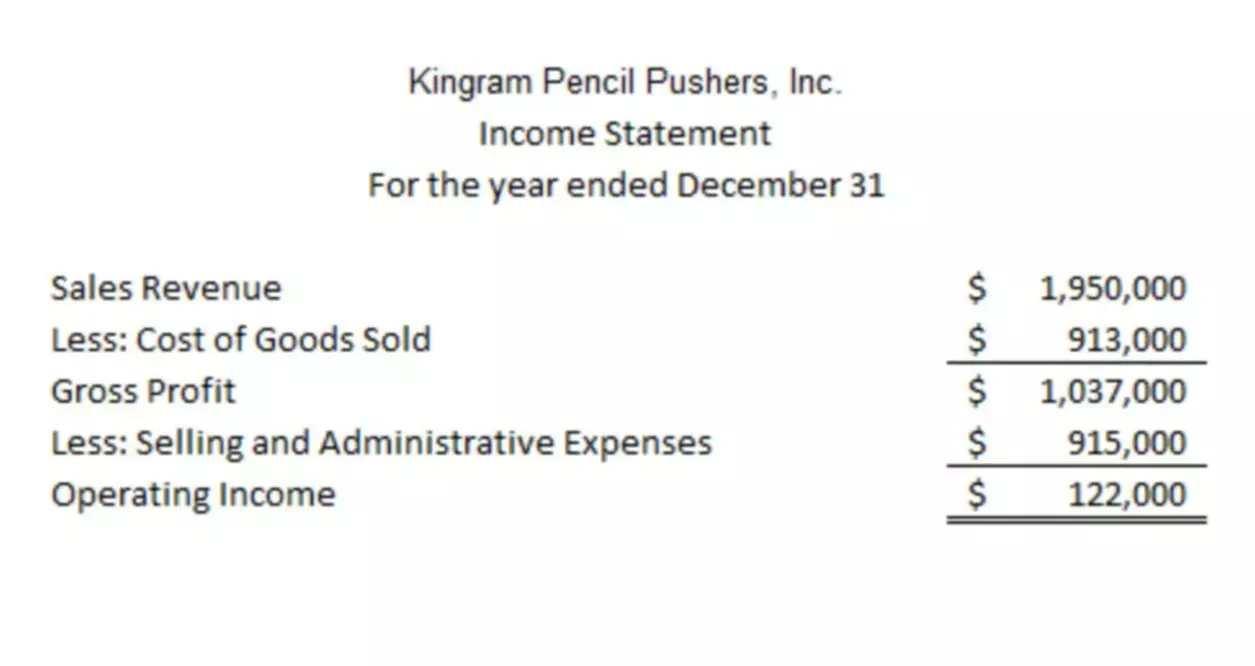

The individual revenue and expense accounts appearing on the income statements are transferred to the income summary account. This can be done by debiting revenue accounts and crediting expense accounts. The credit balance of the revenue account is transferred by debiting the revenue account and crediting the income summary account. Similarly, the debit balances on the expense’s accounts are transferred and zeroed out by debiting the income summary and crediting the individual expenses account. The income summary account is a very useful statement.

The net profit, which in this case is $1, 500,000, can be transferred into the retained earnings account. Permanent accounts start each accounting period with a zero balance. Net working capital is equal to current assets minus accounts payable and accruals. The net income on an income statement can be verified by checking the balance sheet.

permanent account – The most basic difference between the two accounts is that the income statement is a permanent account, reflecting the income and expenses of a company. The income summary, on the other hand, is a temporary account, which is where other temporary accounts like revenues and expenses are compiled.

Transfer the income summary balance to a capital account. Prepare a journal entry that clears out the income summary account. This entry effectively transfers the net income of the business to the owner’s equity account. Next, the same process is performed for expenses. All expenses are closed out by crediting the expense accounts and debiting income summary.

If this is the case, the corporation’s accounting department makes a compound entry to close each dividend account to the retained earnings account. In partnerships, a compound entry transfers each partner’s share of net income summary account income or loss to their own capital account. In corporations, income summary is closed to the retained earnings account. Companies prepare an income summary and an income statement at the end of an accounting period.

All expense and revenue accounts now show a zero balance, and the income summary has a credit balance of $44,000. We can now move that balance over to Retained Earnings. In addition, the income summary closing entry tells us the company’s profit for the year. To reset revenue balances to zero, debit all the revenue accounts to offset existing revenue balances and credit income summary. To reset expense balances to zero, debit income summary and credit all the expense accounts to offset existing expense balances. The earnings transfer also closes the account of income summary. Purrfect Pets has made all the year-end adjustments.

An income summary is a temporary account in which all the revenue and expenses accounts’ closing entries are netted at the accounting period’s end. The resulting balance is considered a profit or loss.

Finally, dividends are closed directly to retained earnings. The retained earnings account is reduced by the amount paid out in dividends through a debit, and the dividends expense is credited.

This will be identical to the items appearing on a balance sheet. The income summary is an intermediate account to which the balances of the revenue and expenses are transferred at the end of the accounting cycle through the closing entries. This way each temporary account can be reset and start with a zero balance in the next accounting period. Note the distinction between adjusting entries and closing entries. Adjusting entries are required to update certain accounts in your general ledger at the end of an accounting period. They must be done before you can prepare your financial statements and income tax return.

Revenue accounts will appear on the credit side of the https://www.bookstime.com/. This is because a revenue account in normal cases will have a credit balance. The income statement is used to record expenses and revenues. The income summary account is used to close out the books. After this entry is made, all temporary accounts, including the income summary account, should have a zero balance. The income statement is used for recording expenses and revenues in one sheet. Income summary, on the other hand, is for closing records of expenses and revenues for a given accounting period.

An investment and research professional, Jay Way started writing financial articles for Web content providers in 2007. He has written for goldprice.org, shareguides.co.uk and upskilled.com.au.